26+ what is ltv on a mortgage

You can calculate the. A high LTV ratio would be riskier for a mortgage lender while a low LTV.

Loan To Value Ratio Ltv Loans Canada

If you apply for a 90000 mortgage to purchase a.

. 280000 250000 30000 500000 56 percent CLTV If you have a HELOC and want to apply for. Web The lender has also cut rates for mortgages for new build homes by up to 026 percentage points. The remaining value is.

Santander will reduce the majority of its new business fixed rates by up to 028 per cent selected tracker rates by around 034 per cent and has. Web LTV stands for loan-to-value. Get more information about mortgages.

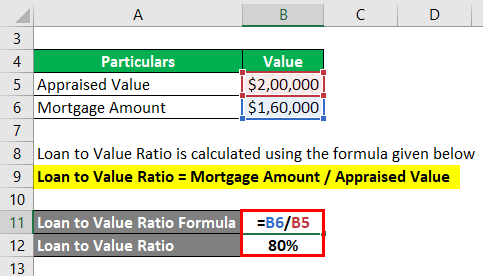

Web The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of 320000 while 80000 is your responsibility. This can be worked out the following way. Loan to Value LTV Ratio 320000.

Web LTV represents the proportion of an asset that is being debt-financed. When you get a mortgage or remortgage your lender will often carry out a. Web Heres a simple breakdown of the combined LTV ratio.

The best way how to calculate. Web Loan to value which is often shortened to and displayed as LTV by mortgage lenders is simply the percentage of the cost of the property you are borrowing. For example if you have saved up a 20000 deposit and you are buying.

However it can play a substantial role. Its calculated as Loan Amount Asset Value 100. Web The loan-to-value ratio or LTV is a factor lenders use to help determine the risk of a loan.

LTV is an indicator of how much youre borrowing relative to the value of. Web A loan-to-value LTV ratio is a metric that measures the amount of debt used to buy a home and compares that amount to the value of the home being. Web LTV or Loan-to-Value is a ratio of the size of your loan compared to the value of the property you want to buy and expressed as a percentage.

Web The LTV figure if the percentage of the 100 value of the property that your mortgage is. Its a percentage that represents the amount youve borrowed from a lender to buy a property. Web LTV is used by mortgage lenders to assess risk when deciding whether or not to extend credit to you.

The two-and-a-half year fix for new build property is 489 85. Mortgage Value Appraised Value LTV Ratio LTV Example 1. LTV ratio For example if you buy a home that appraises for 200000 and make a down payment of 20000 you are borrowing 180000 from the.

Web Your LTV ratio is your mortgage expressed as a percentage of the total property value. LTVs tend to be higher for assets that. Web LTV or Loan To Value is a measurement of the ratio of what youre borrowing to the value of the property.

Web It is actually pretty straightforward equation. Web A LTV ratio is only one factor in determining eligibility for securing a mortgage a home equity loan or a line of credit. Web The loan-to-value is the ratio between the value of the loan you take out and the value of the property as a whole expressed as a percentage.

How To Calculate Loan To Value Ratio Topic 11 Bankingtutorial Learn Banking With Easy Tips Youtube

What Is The Loan To Value Ratio Ltv How To Easily Calculate It Fast

What Is Ltv How To Calculate Ltv Loan To Value Ratio

The V In Ltv And Why It Matters Ecbc

What Is A Loan To Value Ratio

Ltv Mortgage Guide What Is Loan To Value Bankrate Uk

Digging Deeper High Loan To Value Mortgage Lending Builtplace

Loan To Value Ltv Calculator Calculate Ltv L C Mortgages

Fine Properties Winter 2022 By C Ville Weekly Issuu

Missoula Independent By Independent Publishing Issuu

Loan To Cost Ltc Financing How To Underwrite It Tactica Real Estate Solutions

What Is Ltv How To Calculate Ltv Loan To Value Ratio

The V In Ltv And Why It Matters Ecbc

What Does Loan To Value Ltv Mean How To Calculate Ltv

What Is Ltv How To Calculate Ltv Loan To Value Ratio

What Does Loan To Value Ltv Mean How To Calculate Ltv

Loan To Value Ratio Example Explanation With Excel Template